If you are someone who has a salary-based job, you might understand the problem of managing monthly expenses. Now, what if we tell you that you can easily buy your desired products and then pay for them by the next month when you get your salary? Well, if it does, we have good news for you! Flipkart Pay Later by the e-commerce giant Flipkart allows you to do so! Well! Read this complete article to learn more about Flipkart Pay Later, how to use Flipkart pay later, how to activate and deactivate, and much more in detail.

Also read: How to use flipkart gift card

Key Takeaway

01) What is Flipkart pay later?02) Flipkart Pay Later eligibility

03) How to activate Flipkart Pay Later?

04) How to use Flipkart Pay Later?

05) How to use Flipkart Pay Later on Myntra?

06) What are the benefits of using Flipkart Pay Later?

07) Things to remember when you are using Flipkart Pay Later

08) How to pay back on Flipkart

09) How to increase Flipkart Pay Later limit?

10) How to close Flipkart Pay Later?

11) Conclusion

12) Frequently Asked Questions (FAQs)

What is Flipkart Pay Later?

Flipkart Pay Later is a unique payment option by Flipkart to make shopping easy and convenient for its customers. This customer-centric initiative allows you to shop multiple times in a month without paying a single penny at the time of purchase. Flipkart Pay Later offers you credit of up to Rs 1 Lakh to shop all your desired products on Flipkart.

This Flipkart feature allows you to uphold multiple transactions at once and pay later for all of them together. You also get the option to either pay all at once by the end of the month or pay in EMIs over 12 months. The best part about the Flipkart Pay Later feature is that you are allowed pay for the product after you’ve experienced it.

Flipkart Pay Later eligibility

The Flipkart Pay Later eligibility criteria are basic. Flipkart allows everyone to register for the Flipkart Pay Later scheme with some minimal requirements to fulfill. You can use Flipkart Pay Later option if you meet the following conditions:

- Being an Indian citizen is a must.

- The minimum age should be 21 years.

- You should have a bank account with a regular monthly income.

- Valid PAN and Aadhaar number linked to your bank account.

How to activate Flipkart Pay Later?

To Activate Flipkart Pay Later option on your Flipkart account, it requires your Aadhar card and UPI ID to be submitted for verification. Once done, you can use the Pay Later option without any problem. Here are the steps you can use to easily activate Flipkart Pay Later option and unlock all the Pay Later features: -

- Login to your Flipkart account,

- Open 'My Account ',

- In the account section, click on the Flipkart Pay Later option,

- Here, you'll see all the details and an option to activate the feature.

- Enter your PAN card number.

- Click on 'Active now'.

- A new page will open where you can enter your Aadhaar card number,

- Click on 'Continue.'

- A page with 'Terms And Conditions' will open.

- After reading, click on Agree And Submit.

- In the end, enter your UPI ID or bank detail for verification.

- Click on 'Verify And Submit'.

After checking your eligibility, you will be provided with a Flipkart Pay Later credit and EMI limit. It is very simple to unlock Flipkart Pay Later and take all its benefits. But if you are new, these steps will guide you through the process. When done, you'll find Flipkart Pay Later on the check-out page.

How to use Flipkart Pay Later?

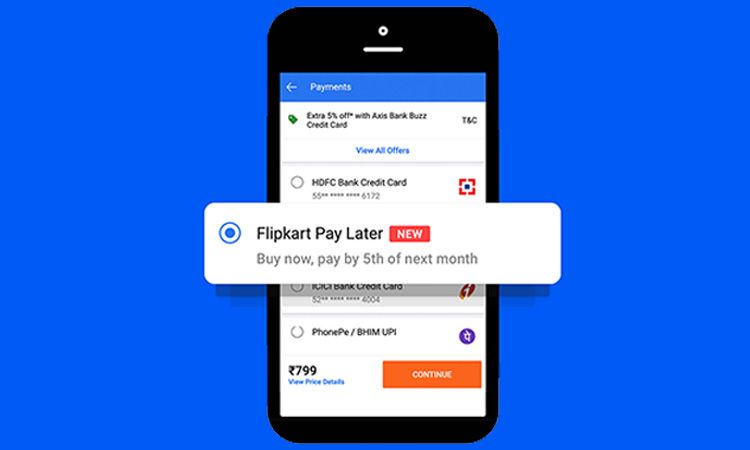

Once your Pay Later option is activated and ready to use, you can easily select the option while checking out. Here is how to use Flipkart Pay Later while placing an order -

- Add your desired products to the cart,

- When done, proceed to checkout.

- Select Flipkart Pay Later as your payment mode.

That is all it takes! Now, you can easily pay your bill by the 5th of next month. Note that not all Flipkart products are eligible for the Pay Later option. Moreover, the purchase can not exceed the credit eligibility given by Flipkart.

Also Read: How to pay using Flipkart Super Coin

How to use Flipkart Pay Later on Myntra?

Since Myntra and Flipkart are partners, you can also use the Flipkart Pay Later feature to get loads of benefits while shopping on Myntra. Get a full, easy guide here "How to use Flipkart Pay Later on Myntra?"

What are the benefits of using Flipkart Pay Later?

There are numerous benefits you can get from the Flipkart Pay Later feature. It includes flexible and speedy payments, club transactions, and more. Here are the advantages of using Flipkart Pay Later: -

Flexible Payment:

With Flipkart Pay Later, you get the option to pay on the 5th of next month or in 12 months duration over EMI. Moreover, you can effectively clear your payment anytime before the due date. This allows you to shop conveniently and flexibly as it follows the same process as your neighborhood grocer.

Buy after experiencing:

Instead of paying for the product while buying it, Flipkart Pay Later gives you the option to buy the product, try it and then make the payment if you like it. This makes your shopping experience even better!

Speedy payment:

Under the Flipkart Pay Later scheme, you can enjoy a one-click payment on all transactions. There are absolutely minimal to no step that needs to be followed to complete the payment. Do it at your ease without any hustle!

Club transactions:

Purchasing several items from Flipkart in just a single month? Well, now you can easily pay for all of them in one go with the help of Flipkart Pay Later. This feature makes club transactions simple!

Things to remember when you are using Flipkart Pay Later.

There are tons of benefits you can get by using Flipkart's Buy Now, Pay Later services. But this facility comes with its terms and conditions. There are some things you should remember before applying and while using this scheme. They are: -

- Partial repayment to clear your balance is not allowed under this scheme.

- This facility is not a wallet, and you cannot park excess money in it.

- If you have an outstanding amount, you will be notified to complete the payment and clear your dues and continue to enjoy the benefit of this scheme.

- This payment option is currently unavailable on the desktop site and will be updated by the company very soon.

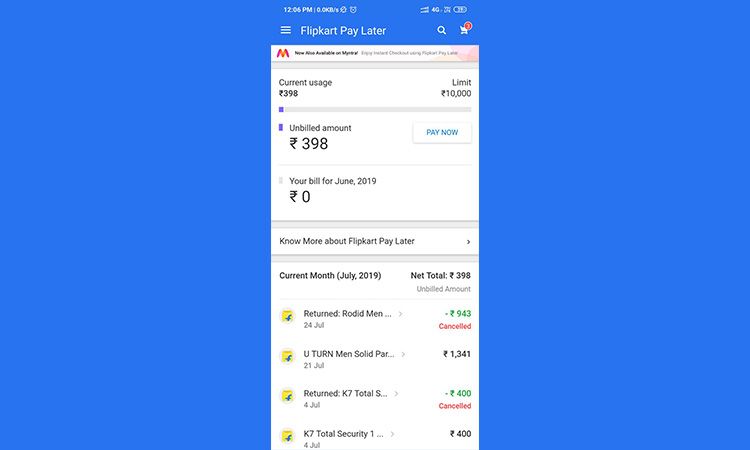

How to pay back on Flipkart?

After completing your month's shopping, it's time for payback. Paying back with Flipkart Pay Later is simple. Here is a quick guide that will help you pay back at the end of the month.

- Check your Flipkart Pay Later statement, where the due date will be visible.

- Now, click on the Pay Bill option.

- Choose the mode of payment you wish to pay from.

- Complete the payment, and that’s it! You’re done.

After the payment is complete, your dues will be cleared, and you can now continue to enjoy your Flipkart Pay Later benefits.

How to close Flipkart Pay Later?

Say you find that the Flipkart Pay Later option is not very useful for you and want to deactivate it. Well, no problem! This is how you can deactivate your Flipkart Pay Later feature:

- Login to your Flipkart account.

- Go to the Flipkart help center page.

- Find the option 'I want help with other issues'.

- Select 'Others'; both times, the option is given.

- You'll find an option to request a callback from the customer care executive.

- Ask the executive to disable the Pay Later feature and send the closure documents by mail.

- It would be disabled within a month and would be reflected in your CIBIL in the next 2-3 months.

Once you are done with this process your Flipkart later feature will be deactivated.

How to increase Flipkart Pay Later limit?

Usually, Flipkart provides the maximum credit limit after checking different factors like CIBIL score and more. But this is something that can change from time to time. According to Flipkart, factors like how long you have been using this feature, the number of successful repayments you have done according to your payment schedule, your customer behaviour, etc., can affect your Flipkart Pay Later limit. This gives you a chance to apply for an increment in your Pay Later limit as well.

Conclusion

Flipkart never fails to come up with customer-centric schemes that make shopping easy and convenient. Just like all the other schemes, Flipkart Pay Later makes shopping fun. It allows you to shop multiple times in a month and pay for it all in a single bill before the due date, which is the 5th of next month, or in EMIs in 12 months.

In this article, you will find all the information you need about Flipkart Pay Later, how to use Flipkart pay later, its benefits, how to close Flipkart Pay Later, and many more. Tell us if you would be going for this Flipkart feature in the comment section. Also, stay tuned with us for more such information.

Frequently Asked Questions (FAQs)

Q1. What happens if the payment is missed under the Pay Later scheme?

Ans1. Flipkart Pay Later is the same as a credit card. If you miss a payment, interest charges will be applied. This will also be recorded on your credit report and affect your credit score.

Q2. Is there an interest payment under Flipkart Pay Later?

Ans2. Yes, you are charged an interest rate on your Pay Later purchases. There can be 'No Cost' EMI offers on special offers or sales.

Q3. Can you use Flipkart Pay Later on other platforms?

Ans3. For now, you can use Flipkart Pay Later on Myntra and 2GUD. To use Flipkart Pay Later on these platforms, you must ensure that your phone number on these platforms is the same as the registered phone number on Flipkart.

Q4. How to know if a particular product is eligible for Flipkart Pay Later scheme?

Ans4. If you are shopping on Flipkart, you have to look for the ‘Flipkart Pay Later’ option under the ‘Easy Payment Options’ section on the product details page. Whereas, while you are shopping on its partnered platforms, a ‘Flipkart Pay Later’ option would be visible on the payment page if your order is eligible.

Q5. Does Flipkart Pay Later EMI have an interest rate?

Ans5. Yes, the EMI option in Flipkart Pay Later has an interest rate of 16% to 22%, which is much higher than a credit card interest rate.