Paytm has joined hands with ICICI Bank and offers Paytm postpaid services to provide its users with the convenience of short-term credit. It is a convenient method that allows users to shop without making instant payments. However, situations may occur, and sometimes you need to increase your Paytm postpaid limit to make larger transactions. So to meet your financial need, we will help you with many ways to increase your Paytm postpaid limit up to Rs 1,00,000. Let’s dive in to know How to increase Paytm postpaid limit effortlessly.

Key Takeaway

What is Paytm postpaid?

Paytm, one of the most renowned digital payment platforms, offers an amazing feature with the name Paytm Postpaid. It is a credit feature that permits users to make purchases on 1 crore+ websites & merchants without making an immediate payment. With the use of Paytm postpaid services, users can enjoy the hassle-free service of “Buy Now, Pay Later”.

Paytm postpaid collaborated with two NBFCs to provide users with the convenience of credit up to Rs. 60,000 for up to 30 days with no interest. You can also increase paytm postpaid limit up to Rs. 1,00,000. Users are eligible to pay for their bills, recharge or tickets using Paytm postpaid. To activate Paytm postpaid service, users need to complete the process on the Paytm app itself and are required to repay the amount of credit within 7 days of the following month.

How to increase Paytm Postpaid limit?

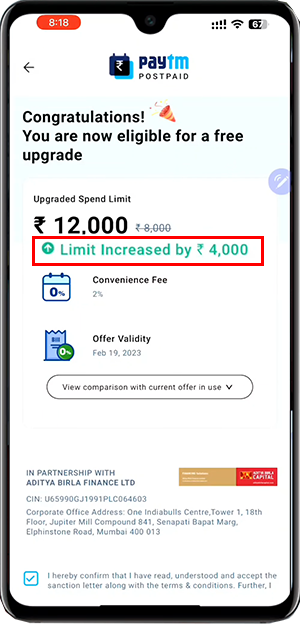

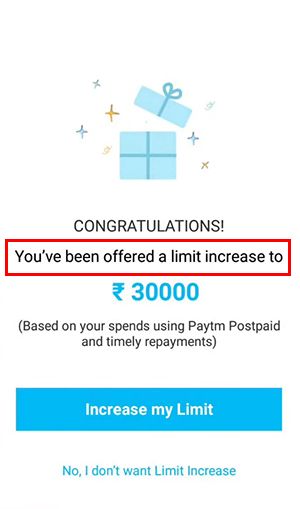

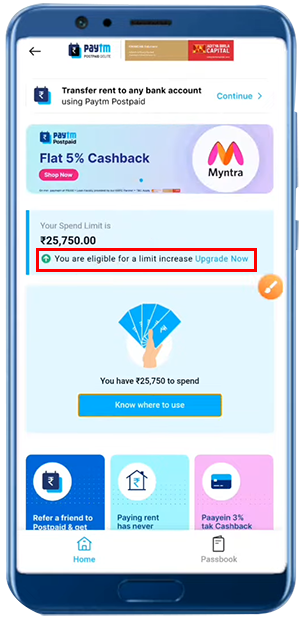

Are you someone who is not satisfied with the Paytm postpaid limit and is thinking how to increase the Paytm postpaid limit? Well, Paytm postpaid is exactly like a credit card; the more often you purchase, the more limits it offers but you should also pay your dues on time. So, if you want to increase your Paytm postpaid limit, you need to use Paytm postpaid frequently, as Paytm postpaid considers your shopping history and also considers your clearance of dues on a timely basis.

How to activate Paytm Postpaid service?

Firstly open Paytm. Log in to your Paytm account, and click on the search icon available on the top right side of the home screen; now type “Paytm postpaid”.

- To get started with the process, tap on the Paytm postpaid icon. You are now, required to provide some important details like PAN card, Aadhaar card and DOB.

- After providing all the information and completing the digital KYC process, you need to review the offer and accept the terms and conditions.

- Paytm postpaid services will be activated immediately, and you can check your credit limit under the “accounts tab.”

Now you are done and can start your shopping using Paytm Buy Now and pay later services.

How to use Paytm postpaid balance?

It is easy to use Paytm postpaid balance and you can even use Paytm balance for various purposes. So here are some of the ways where you can make use of your Paytm postpaid balance effectively.

- Using the Paytm postpaid balance, you can recharge your mobile number and pay for utilities like electricity, water, and gas, as well as for your DTH services. You only need to choose the appropriate recharge option, fill out the necessary information, and select Paytm postpaid as your payment option.

- You can use your Paytm postpaid balance to purchase a variety of goods at the Paytm Mall. Browse the extensive selection, add the things you want to your cart, check out, and choose Paytm postpaid as your method of payment. Your amount will be deducted automatically from your Paytm postpaid balance.

- Paytm postpaid offers a smooth movie ticket purchasing experience. On the Paytm app, choose your desired movie, showtime, and seats. Select Paytm postpaid as your payment method to finish the transaction using your available balance.

- If you are planning a trip, Paytm postpaid balance can be used to reserve a hotel, train, or bus. Enter your travel information, pick your desired option, and then pay. To make the reservation using Paytm postpaid, select it as your payment option.

Conclusion

Paytm postpaid is a great initiative by Paytm that provides users with a smooth payment experience. Activating the Paytm postpaid is a convenient method and can be done within no time. Once it is activated you can easily shop for up to Rs. 60000. And if you are not satisfied with your payment limit, you can also increase it up to Rs. 100000, but the only way to increase your Paytm postpaid limit is to shop frequently and repay the amount without any delay.

Frequently Asked Questions

Q1. What is the maximum limit of Paytm postpaid credit?

Ans. The maximum limit of Paytm postpaid credit is Rs 100000.

Q2. Does Paytm postpaid affect credit score?

Ans. When you start using Paytm postpaid, your payment history will be shared with the credit bureaus. And as soon they receive your Paytm postpaid report, they will start building your credit score. So to maintain it, you need to make repayments before the due date, and if you delay, it will cause your credit score to go down.

Q3. Why is my Paytm postpaid application not accepted?

Ans. It happens when you do not meet the eligibility criteria. So apply and check out if you are eligible for the same.